With increased grapevine whispers in recent weeks about more exchange insolvencies looming on the horizon the rumour mill has been picking up speed.

Who is next? What will the impact be on the Bitcoin prices and crypto markets in general? Will deteriorating appetite for counterparty risk further nuke the credit markets in the industry and expose unhealthy balance sheets?

We asked ourselves a different question:

How would Cryptocurrency owners¹ be affected?

So we went out and surveyed our followers as well as members of the Vietnamese Cryptocurrency community accordingly².

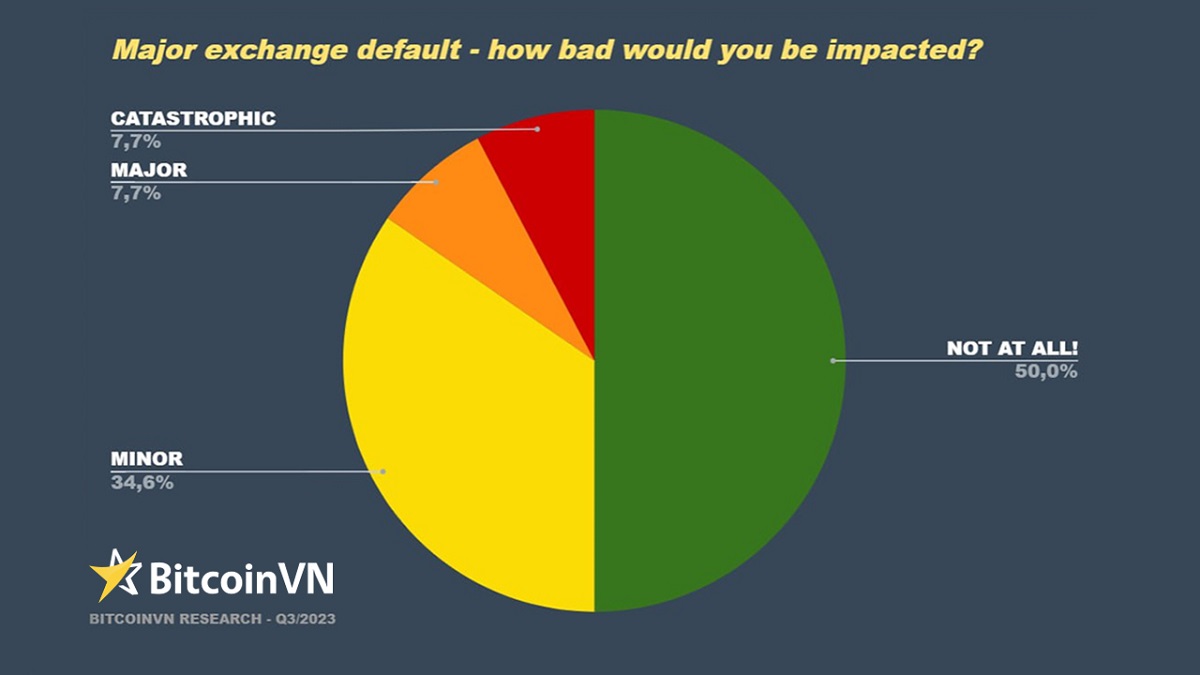

The responses we received paint a far less scary picture than one might initially expect:

A majority of users seems to have implemented prudent risk management practices when it comes to exposure to trusted third parties.

While there still remains a significant number of people whose reliance on third parties to not derail their life plans is worrisome, the campaigns towards self-custody and “not your keys, not your coins” seem to have borne fruit.

Now… the cynic in us might of course say:

“Well, the people who did not implement prudent risk management have already lost their coins and exited the game!”

And that may very well be true.

We should note that this survey was conducted amidst the bear market and following a year of countless blow-ups (Celsius, FTX, BlockFi and a plentitude of mid- and smaller players) where billions of dollars worth of claims became suddenly unredeemable.

The people who failed to take self-custody seriously in time learned already the hard way that storing your money with a third party is an accident waiting to happen.

—

If you are looking to ramp up your own security and to get your hands on a hardware wallet in Vietnam – our colleagues at BitcoinVN Shop have as authorized supplier all the common models from Ledger, Trezor, Coinkite / Coldcard and Blockstream (Jade) in their line-up.

No more hassle with international shipping and customs – delivered straight to your door from our warehouse in Vietnam.

Questions? Reach out to our team via the contact form.

—

(1) Not in the strict sense of the word, in this case we included claim (IOU) holders as well (= people outsource the control of their savings to a trusted third party) which is the more popular – albeit factually incorrect – way to describe “Cryptocurrency owners”

(2) Please take note that this survey is not following scientific research standards and is just a snapshot of a specific community at a specific point in time.

Some potential sample biases might include:

- Information bias

- Non-response error

- Response bias

- Survivorship bias