The recent announcement by Cryptocurrency Exchange Binance to extend its “monitoring tag” (indicating a potential delisting) to Monero, the world’s favourite privacy coin, has caused a lot of uncertainty with Monero investors.

But what are the consequences of such action for Monero and its users?

First of all:

Monero will continue to work as usual

For Monero users a potential delisting by Binance has zero impact.

You can use the Monero network and your own wallet as usual.

You can’t use Binance anymore in case the delisting goes ahead, but you should not use centralized exchanges to store your digital assets in any case.

“But won’t the price of Monero dump?!?”

This is indeed a very real possibility.

BUT: Not a certainty!

While there is plenty of evidence that the delisting of coins from ever more platforms will lead to a lack of access and liquidity, leading to dwindling interest and capital flows into the cryptocurrencies affected by it (think for example: Counterparty or – on the opposing side of the “legitimate” spectrum: BitcoinSV)…

…there is also the “conspiracy theory” that a cabal of big exchanges in connection with whale traders and/or “big government” have been running a clandestine operation to suppress the Monero price due to the introduction of an unlimited number of “paper Monero”.

It is by now well-established that this very mechanism has been used by the masters of the universe to suppress the price of gold:

- Concentrate physical gold with centralized custodians

- The trading volume of “paper gold” consequentially dwarfs the trading volume of physical gold around the world

- The pricing power is established firmly within the centralized trading platforms

If the demand for Monero from real users is large enough, the pricing power (and that is the hope and belief of many “Monero maximalists” and adjunct sympathizers) will indeed shift back to P2P markets.

And a disappearance of the “paper Monero” issued by centralized database providers such as exchanges will result in a corresponding drastic reduction in Monero supply.

Given how many so-called “conspiracy theories” over the past few years turned out to be simple plain and harsh reality:

“The Monero price sucked for years – why would it change now?!”

A statement made by a speculator rather than a user.

If you are just in it to make quick profits, then there are quite possibly other more attractive tools out there.

And no, we don’t have a tip which one the “hot coin of the month” is.

“Monero is a currency and not an investment!”

…is a position by more hardcore users in the Monero camp.

And there are good arguments for this position to be made:

Monero’s primary purpose is to be the most private and untraceable internet money in existence.

Hated by the surveillance state – and loved by freedom- & privacy-loving anon users.

Monero is not optimized for “hodling” or playing a role as “store of value” – but meant to flow and enable digital commerce with minimal traces.

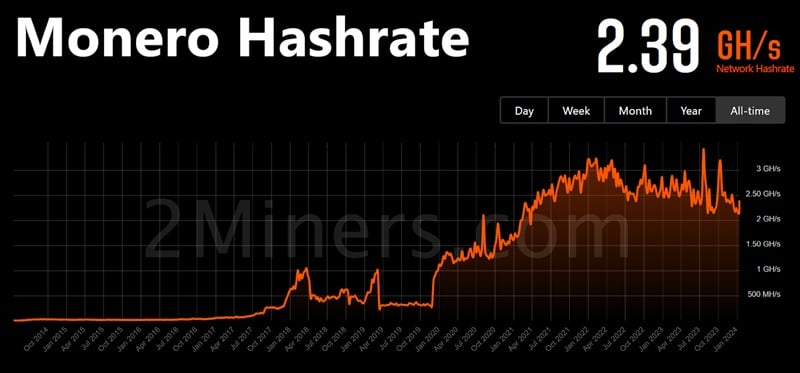

“The Monero community does not have critical mass to sustain current price levels!”

Well, we don’t know about that.

What we can say however is that by qualitative (our interaction with Monero users and the Monero community) and quantitative observation the Monero user base seems by far one of the most active across the entire “cryptocurrency” complex.

Active as in:

Actually using Monero and the software rather than clicking buy and sell buttons on exchanges.

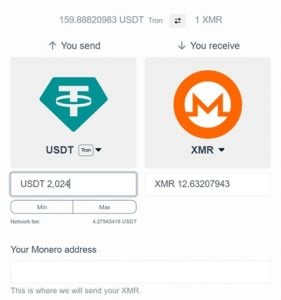

“I don’t know how to buy Monero anymore without Binance!”

Well, we do.

Click here.

No sign-up required – unless you plan to fund your account with Vietnamese Dong (VND).

“I don’t know how to store my Monero without Binance!”

While you can store your Monero with other third parties, it is not a recommended practice.

Preferably you use your own wallet and keep control over your own keys, ideally in connection with a signing device like Ledger or Trezor.

“But how do I earn staking yield on my Monero now?”

Monero does not have “native” staking yield functionality.

The only way to “let your Monero work for you” is to “invest” them with a third party provider.

And yes, you can provide liquidity to BitcoinVN users via our staking program.

However:

Unless you fully understand the risks of storing your coins with a third party, see as above.

Your Monero generally feel the most cozy in your own wallet, protected by a dedicated signing device such as Ledger or Trezor.