(TL, DR: You can purchase XAUt from BitcoinVN here)

As we enter the last stretches of the current fiat monetary system an old favourite of hard money proponents is starting to move more back into the spotlight:

The eternal classical store of value, Gold.

Gold – securing economic energy since millenia

Gold – due to its inherent properties – became the dominating form of commodity money.

Before the advent of Bitcoin, Gold was the hardest and soundest money in existence. Cultures utilizing Gold as money thereby were able to obliterate those who still relied on softer forms of money in the eternal strive for power and domination of energy and resources.

The basic formula is, that that type of money will come to dominate, which allows for the protection of one’s purchasing power (stored economic energy) with the least amount of associated cost (leakage of stored economic energy).

These are some of the basic foundational reasons why it is still possible to “buy a decent suit” for the price of an ounce of Gold now as it was the case centuries ago.

“Imma steal yo Gold!” – Central banks keep hoarding shiny rocks

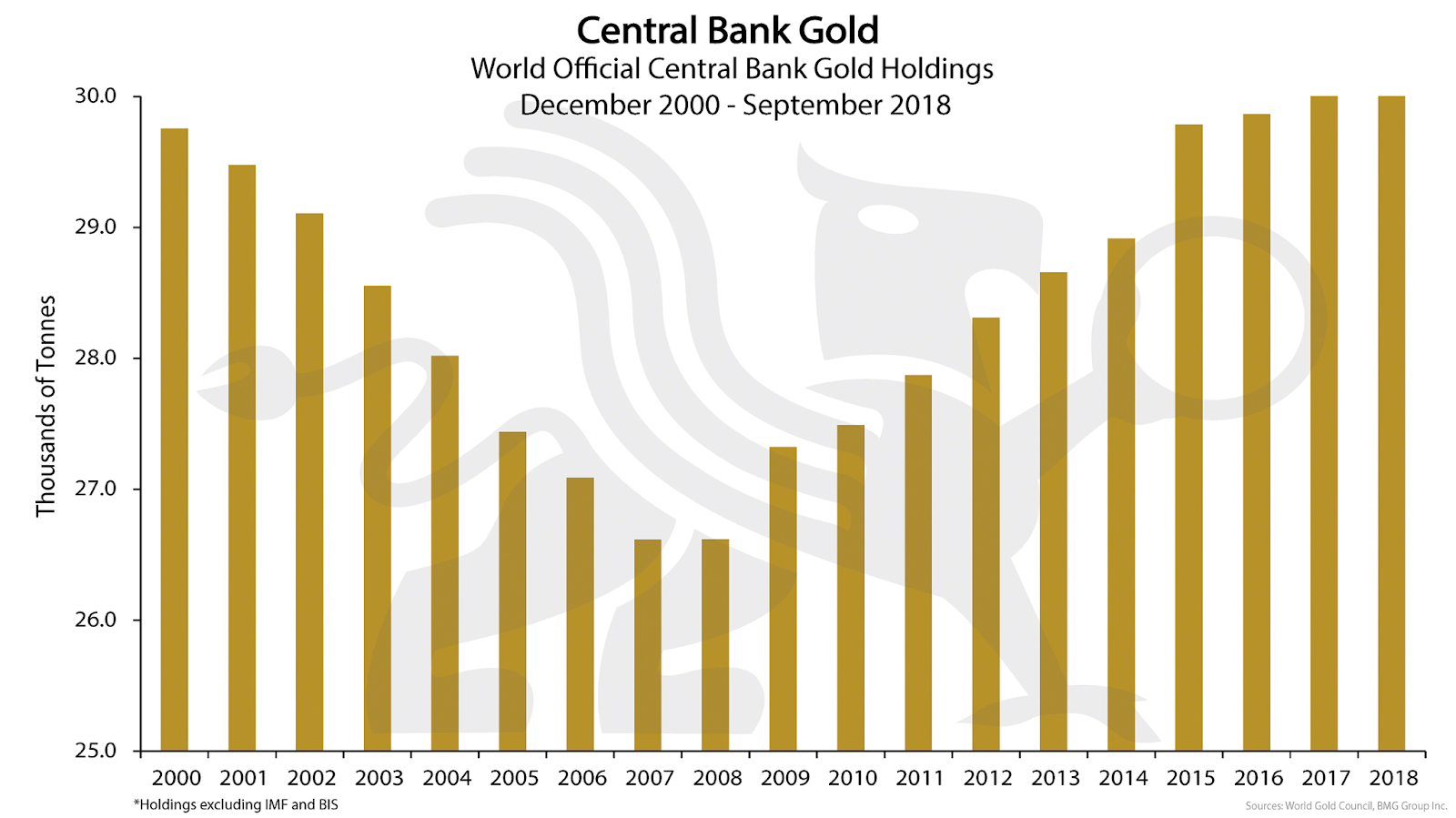

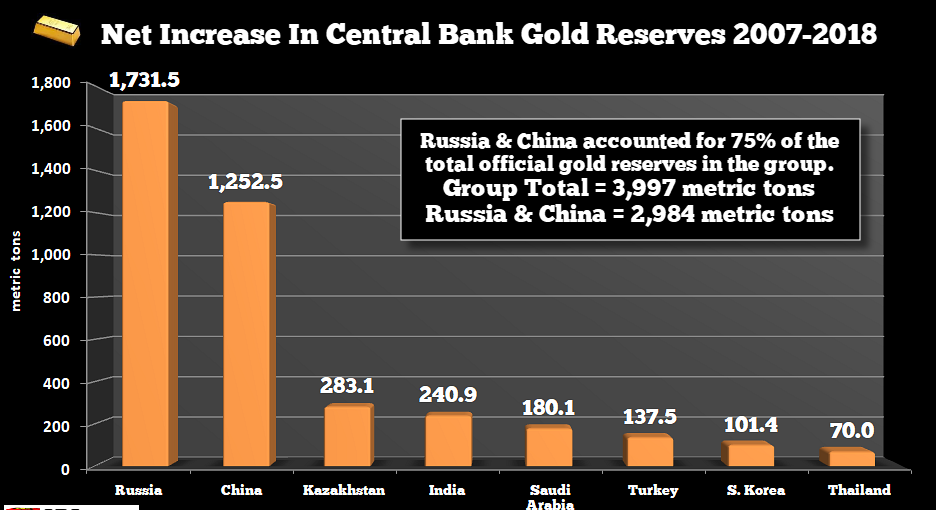

In the full knowledge that unbacked fiat currency schemes always collapse over time.(first gradually, then suddenly), central banks – basically.institutions which have mastered “to gain something for nothing”.(obtain control over the population’s gold in exchange for unbacked paper receipts).– are still hoarding Gold today.

While paid fiat propagandists such as Paul Krugman keep telling the public.that it’s just “a barbaric relic” – central bankers and their friends do,.as usual, the opposite of what they tell the public.and massively increased their Gold holdings since the bankruptcy.of the global financial system back in 2008.

Due to the strong centralization pressures associated with the storage and transport costs of Gold, the most powerful and violent custodians usually ended up with the Gold – either by using deceit and purposefully abusing the trust of the population to give up self-custody of Gold or by simply threatening violence (“outlawing”) if people refuse to hand over their Gold into the hands of central banks.

While Gold indeed shows shortcomings in terms of cost of storage, risk of counterfeits and high cost of transport in comparison to Bitcoin, we can recommend for a more recent in-depth discussion around the pros and cons of Gold in the modern age, the recent debate between Microstrategy’s Michael Saylor with Canadian mining mogul Frank Giustra hosted on Stansberry Research.

Tether Gold

Tether Gold (XAUt) is a product provided by Tether Inc. – following up on the success of its USDt product which since its inception in 2014 ballooned to the world’s most successful stablecoin with about $80bn AUM.

Tether Gold currently has a market cap of approx. 246,000 oz of Gold as of time of writing this article ($450m+ market value).

Tether Inc. claims that each XAUt is fully backed and redeemable.by actual physical.Gold – thereby allowing Gold to be traded/transferred/utilized.on various Blockchains as is done in the case of USDt.

XAUt is necessarily and by design a custodial solution to own Gold. If you are looking to prepare for the collapse.and want to have.some physical Gold at hand, this is *not* the solution.you are looking for.– albeit it is possible to redeem XAUt for physical Gold.at selected locations.

Purchase XAUt with VND

Not everybody is convinced of the utility of Gold as the future of money

—

If you have an interest in receiving physical gold, please let us know via the contact form on BitcoinVN (bottom right) or our Telegram channel – depending upon demand we might provide physical delivery as a regular service in the future.

—

Graphic: Schiff / Krugman