Looking at the comparatively high APR offered by the BitcoinVN staking program, the (rightful) initial question of the visitor is of course: “WHERE IS THE YIELD COMING FROM?”

After the blow-up of various ponzi schemes in the first half of 2022 users have learned to ask the right questions.

“But now tell us… where DOES the yield come from?”

BitcoinVN is a Cryptocurrency Exchange (in fact: The first in Vietnam with almost a decade of operating experience behind it) which takes a small percentage in fees on every swap.

In exchange for providing liquidity, depositors can earn a share of the exchange volume of the staked asset *(the formula can be found here).

There are no promised fixed returns!

If the asset you staked tends to get used a lot, the APR goes up.

The more the asset you staked is utilized in swaps on BitcoinVN, the more you earn (and vice versa).

How is that different from a ponzi scheme?

A ponzi scheme has no actual business model to generate the promised returns to depositors.

The only way to pay out the promised yields is via gaining ever more depositors at an ever faster pace, until the whole scheme ultimately and inevitably collapses.

The “business model” of a Ponzi scheme is solely to gain enough depositors to pay out the old depositors (plus their “yield”).

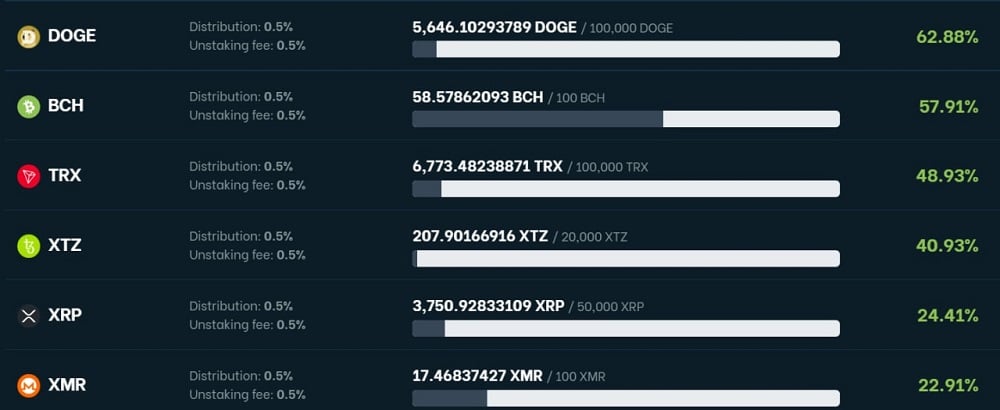

BitcoinVN staking pool limit sizes

BitcoinVN is capping the pool size at relatively small amounts of usually just (in USD terms) mid-5 to low-6-digit amounts per pool.

Why?

Because there is simply (currently) no need to access more liquidity to facilitate the exchange operations.

We neither need nor want millions of dollars worth in deposited assets. The downsides clearly outweigh the upsides for us.

That might sound like a very conservative approach to business, and that’s probably because it is.

That said:

If somebody without any type of track record is soliciting its user base for millions of dollars in funding/deposits… you might want to take your money and walk the other way (fast). Unless you like to gamble. Caveat emptor.

What are the risks?

It is a custodial service.

So the usual risk advice applies:

- Never deposit more than you can afford to lose

- Not your keys, not your coins

And while we believe that our track record of running the service for almost a decade gives us sufficient experience in terms of risk management and cybersecurity, we still prefer to not be responsible for your life savings. 🙂

So use the service at your own discretion, be aware of the risks.

And for your life savings:

Please make yourself familiar with managing your own keys and consider obtaining a hardware wallet.