Knowing the difference will save you a whole lot of money.

Sending the wrong token can result in a loss of funds or expensive recovery fees – money you can save by knowing the difference and applying your knowledge with care.

What is the difference between USDC and USDC.e?

USDC and USDC.e are not the same token.

USDC is directly issued by the stablecoin giant Circle, meaning the liability and counterparty risk are solely with Circle.

Holding USDC essentially makes you a “creditor” to Circle.

What about USDC.e?

USDC.e is a token typically issued by the corresponding “Blockchain Foundation” or a similar entity.

It serves as an IOU for “real” USDC, backed by USDC held by the foundation/entity issuing these IOU tokens.

In the case of USDC.e, the liability and counterparty risk lie with the issuing foundation/entity—not with Circle.

While a default by Circle on their USDC liabilities would naturally trigger a domino effect impacting USDC.e, the USDC.e token inherently carries a significantly higher counterparty risk.

Not only must you trust Circle not to default on USDC, but you also have to trust the IOU token issuer (the foundation or similar entity) not to default on backing the USDC.e tokens.

If the foundation—for any reason—loses or mishandles the backing of the USDC.e token, USDC.e could lose value even if USDC itself remains stable.

Why was USDC.e created?

The official reason is that on some of the blockchains where USDC.e tokens are available today, Circle did not initially offer native issuance of USDC.

Hence, there was a need for a trusted third party to accept USDC deposits in exchange for USDC IOUs on that blockchain (commonly known as a “bridge”).

Part of the motivation is certainly to bring a (proxy) stablecoin to the blockchain to enable wider usage in the absence of “real” USDC.

Why was USDC.e not phased out once USDC got natively issued?

One common “conspiracy theory”:

That vast quantities of USDCe are sent into nirvana every year (depositing USDCe when USDC was required) results in 100% pure profit for the foundation issuing these tokens.

The more USDCe tokens that become irretrievably lost, the fewer liabilities the foundation will have to cover in the future (a concept in finance known as “Breakage”).

In short:

The foundation can keep the “real” USDC while the IOUs are lost.

Your loss, their gain.

It might explain why almost all user interfaces make it so easy to mix up the “real” USDC with the USDCe IOU token.

This is, of course, just a conspiracy theory…

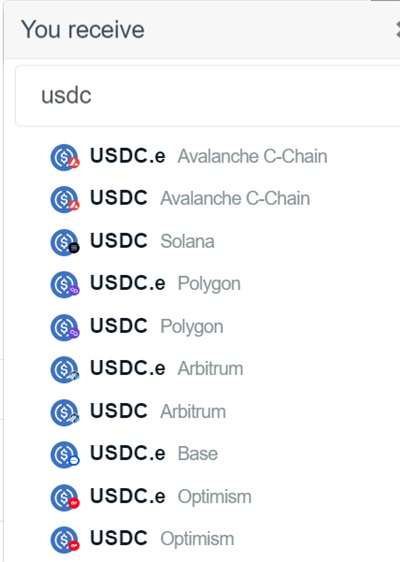

Which blockchains support USDC.e?

Currently, on the BitcoinVN platform, support is enabled for USDC.e on the Avalanche (C-Chain), Polygon Network, Arbitrum, Base, and Optimism.

How to avoid sending the wrong token?

Paying attention!

It is generally good life advice in order to make smart and informed decisions.

Double-check that you’ve selected the correct token before making your deposit or completing your order.

What to do if I still sent the wrong token?

Depending on the service you are using, this might result in a total loss.

Other services will likely charge you a recovery fee.

Why am I charged a recovery fee for sending the wrong token? 😡

Recovering the wrong token requires manual effort and time from key team members, who are often on a very expensive hourly salary.

For obvious reasons only a few selected people within the organization can move funds, and it often requires the involvement of multiple key individuals.

This is a VERY COSTLY process, so triggering it necessarily comes with a fee.

So, avoid sending the wrong token! 🙂

Man, all this crypto stuff is really confusing. Can I get some help somehow? 😭

Yes.

One way to learn is by doing it yourself. There’s plenty of free information available on this website and across the wider Internet.

However, be aware that there is also a lot of bad information out there, and it’s up to you to filter it correctly.

If you want to speed up the process:

Yes, we do offer professional consulting services. Please note that this is, of course, a paid service.

You’ll be working with experts who have years of experience and an extremely solid track record of providing clients with advice that has kept them safe while building intergenerational wealth.

If you’re interested, feel free to get in touch here to book your session.