The short answer is:

Yes.

Currently, the Monero staking vault (at the time of compiling this article) is fetching close to 50% APR and is at its current maximum capacity.

![]()

While our team has the discretion to increase the staking vault size in case we deem additional liquidity beneficial for smooth operations of our service, there is no guarantee that this will happen.

Which means that, yes, the staking vault might be full and if you have not secured your allocation in time:

You might be too late.

How can I stake Monero at BitcoinVN now?

Currently, you can’t.

With that said, if you are keen to jump on your first chance to do so once a spot opens up, you can watch out for the following:

- Regularly check our BitcoinVN Staking page

Once some of the current Monero stakers unstake their sXMR, there is a possibility to snatch up some of the available sXMR if you are fast enough.

Keeping a close eye on our staking page will help you spot any opportunities opening up.

2. Purchase sXMR via our OTC desk

While there is currently no concrete offer available, our OTC desk team is considering offering further bulk issuance of sXMR to some of our BitcoinVN Private Clients.

To be the early in receiving any related news, see point four in this list.

3. Buy sXMR from existing sXMR holders

This function is currently not available on the platform; however, we are strongly considering opening up a marketplace.

Such a marketplace would allow you to purchase sXMR from current holders at a price agreed upon by both buyers and sellers. This would all take place on your trusted BitcoinVN platform, ensuring that each buyer and seller receives the corresponding asset and that fraud is prevented.

Keep a close eye on our news and announcements in the weeks ahead.

4. Subscribe to our BitcoinVN Newsletter

To ensure you don’t miss out on any news releases from us, we recommend signing up for our newsletter.

Please note that some of our newsletters are exclusively sent to active participants of our staking program. Therefore, if you haven’t already, you might want to stake at least five bucks in any of the assets on offer to qualify for these emails.

Why does BitcoinVN limit staking vault size?

Because we do not want to take on more client funds than necessary!

Since our inception over ten years ago, we have been strong advocates for self-custody. We provide educational materials, tools, and guidance to empower you to be the master of your own money (and keys!).

The space is filled with shady businesses and operators who seek to control as much client money as possible, which often ends badly, especially for depositors.

The funds in the staking vaults are actively used to provide liquidity for our swap service. However, once we feel we do not need any further funds to provide our service, we will simply stop accepting additional funds.

Limiting our liabilities and the amount of client funds we need to secure also mitigates our business risk. Our longevity, with over a decade in business, speaks for itself, indicating that this risk-aware approach has been correct.

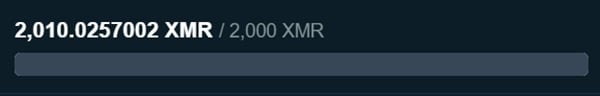

Why are there more XMR staked than max limit?

Now, you might ask yourself:

Why are there more sXMR issued than the maximum staking vault target size?

The answer is simple:

The auto-restaking feature allows you to automatically convert any XMR staking rewards into additional sXMR.

So yes, the early stakers who got in on time have another advantage:

They will be able to receive additional sXMR beyond the capacity limit.

Even if someone unstakes, for example, 10 sXMR right now, no new participants will be able to purchase sXMR. This is because we are still above the vault target size.

The remaining staking participants will enjoy a higher APR per sXMR.

This is because any staking rewards will be distributed among, in this example, 2,000 sXMR rather than 2,010 sXMR.

Thus, increasing the share of staking rewards distributed per sXMR.

What are my choices now?

While you might have missed your chance for the time being to stake Monero with BitcoinVN, there are a variety of other assets that still have available allocations in their corresponding staking vaults.

As outlined above, there are certain benefits to “getting in on time”. However, we highly recommend:

- Being aware of and understanding what it means to give up self-custody of your funds.

- Making your own risk assessments on the underlying assets.

We do not intend to convince you to, for example, invest in Dogecoin. Unless you truly understand the choices you make, you should not view any of the offerings as investment advice.

Over the long term, investors who take well-calculated risks tend to fare best, so understand what you’re getting into before doing so.