With wBTC, the former frontrunner in the “wrapped Bitcoin” space, seeing a sharp decline in trust ratings after its recent takeover by Justin Sun, the market is now wide open for new competitors.

In August 2024, BitGo, one of wBTC’s former custodians, made a somewhat surprising announcement that Justin Sun, through his entity BiT Global, would become a major stakeholder in wBTC, leaving the industry with much to interpret.

While BitGo CEO Mike Belshe quickly reassured wBTC investors that “no single party has the ability to mint or withdraw from the underlying treasury,” Justin Sun’s reputation as a seasoned corporate raider in the crypto industry – having previously drained the reserves of Poloniex, Huobi/HTX, and TrueUSD, among other takeover targets – has nonetheless sent shockwaves through entities and individuals with wBTC exposure.

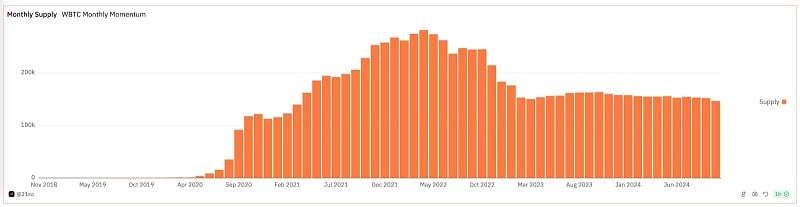

Predictably, trust in wBTC is plummeting.

The circulating supply is contracting as various trading desks and investors adjust risk ratings and increase discount rates on wBTC.

In response to the market gap left by wBTC’s declining trust, established Western exchanges like Coinbase and Kraken have introduced their own wrapped Bitcoin tokens—cbBTC and kBTC, respectively.

Kraken, in particular, has garnered a strong reputation among early cryptocurrency adopters for its transparent operations and the principled leadership of its co-founder and former CEO, Jesse Powell.

Founded in 2011 as an alternative to the then-dominant Mt. Gox exchange, Kraken has navigated the volatile crypto landscape with consistent integrity, solidifying its status as a trusted industry leader.

In an exclusive statement to BitcoinVN News a representative from Kraken, emphasized:

“Our mission constantly challenges us to find innovative ways to accelerate the global adoption of crypto. kBTC builds upon Bitcoin’s fundamental strengths – security, scarcity and its role as a store of value – and extends its utility further, into DeFi and beyond.”

Why Bitcoin IOU? 🧐

Now, if you take a very puristic view, the only real Bitcoin you should ever touch is the actual thing, securely placed in your own wallet (and ideally, in a multisig setup).

But purists aren’t the target for Bitcoin IOUs issued on other chains, which inherently carry some level of trust in third parties.

If the custodian (like Kraken, Coinbase, or others) were to default or mishandle the backing, you could be at risk of loss. These Bitcoin IOUs reintroduce counterparty risk, and it’s prudent not to place a significant portion of your life savings in them.

With that said, Bitcoin-backed IOU’s allow certain market participants to utilize a Bitcoin-derived instrument to collateralize their Bitcoin in order to conduct more sophisticated financial transactions, such as taking out loans on DeFi protocols and similar activities.

In a certain and not 100% “Bitcoin maximalist” compliant – sense, these products help make Bitcoin as pristine collateral a more widespread option.

In a certain and not 100% “Bitcoin maximalist” compliant – sense, these products help make Bitcoin as pristine collateral a more widespread option.

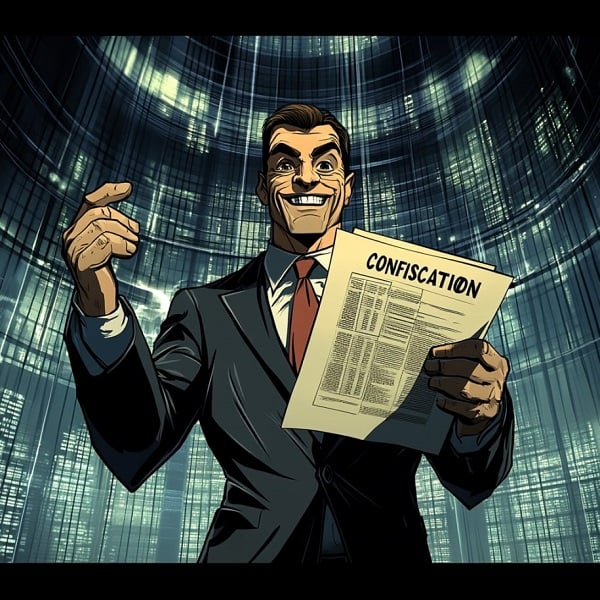

However, the “downside” is also clear:

More actual Bitcoin allocated in the hands of a few licensed custodians who, in extreme cases, might be compelled to hand over their Bitcoin to the Treasury if a repeat of E.O. 6102 or similar measures were enacted due to financial calamities in the public coffers of the corresponding nation state.

If you’re looking to use Bitcoin-backed tokens in DeFi, kBTC is among the most reliable options available.

For long-term storage of your life savings, however, you might prefer to hold the real thing and secure it carefully, with the keys fully under your control.

>>> Read more: How to buy and sell KBTC in Vietnam

How do I secure my kBTC?

Since kBTC is not “the real thing,” Bitcoin-only wallets like Coldcard and Blockstream Jade are not an option here.

Since kBTC is not “the real thing,” Bitcoin-only wallets like Coldcard and Blockstream Jade are not an option here.

kBTC is a tokenized asset issued by Kraken, meaning it requires hardware wallets compatible with the chains where kBTC is hosted.

Currently, kBTC is available on Ethereum mainnet and Optimism, both supported by all Trezor and Ledger models.

Keep in mind, however, that kBTC and similar crypto wallets are not a replacement for a long-term Bitcoin strategy.

A secure multisig setup with steadily growing Bitcoin savings remains essential.