Andreas Kohl is certainly a man with a unique CV, starting with him being a holder of four different nationalities.

From there, it should not surprise you that Andreas has made some pretty unique contributions over the years to the Bitcoin ecosystem and the wider libertarian-minded movement.

Early on, he contributed to advance Bitcoin expertise in the alpine principality of Liechtenstein, became a contributor to the Mises Institute, and has lately chosen to support El Salvador’s journey of growth as a nation that exemplifies how a country can bounce back, even from a very bad starting point, if the right leadership and governance are in place.

As an active member of the Bitcoin community in Saigon he also brought about the first pop-up Pupuseria in Vietnam during the Summer Flea Market of the local community.

Recently, he’s started his own Free and Open Source Software (FOSS) development studio, Concatena Labs, focused on enabling disintermediated financial markets by building the Sequentia Network, a sidechain of the most secure network known to mankind— Bitcoin.

BitcoinVN News: When did you first come across Bitcoin, and what inspired you to dedicate a significant part of your life to the “orange phenomenon”?

Andreas Kohl: In 2012, a few months before my 17th birthday, I found myself unable to pursue the higher education that I had envisioned for myself; although at that point I had lived most of my life in the UK, I learned that the State would only provide the subsidies that I needed to continue my education if I could show that I had resided in the UK for the previous 3 consecutive years. Unfortunately (or in hindsight, perhaps fortunately), I had never lived in any one place for that long – my parents, who are themselves cosmopolitan melting pots with no strong connection to any one land, had taken the habit of moving across Europe every couple of years. It was this same instability that led to my emancipation and financial independence at such a young age.

To make a long story short, I ended up entering the workforce at 16, and soon found myself working as a Junior Tax Accountant at a small office in the district of Chiswick, in London, which specialized in working with French expats. Far from awakening a passion for bookkeeping or tax planning, my work made me question the entire system in which I had become yet another cogwheel. I started pondering the necessity of my position within civilized society, and indeed, the entire system of taxation altogether.

My first exposure to Bitcoin came from following the wikileaks saga, which was unfolding very close to home. I was disgusted by the military-industrial complex which I saw as a principal benefactor of taxation, and which clearly – as revealed by Wikileaks – abused human rights in service of private interests. When Julian Assange entered the Ecuadorian Embassy in Knightsbridge seeking refuge from persecution by Western governments, and rumors started spreading of a possible police incursion into the embassy in violation of international law, I knew that I had to be there, if nothing else, to at the very least stand witness.

I spent almost 48 hours in front of the embassy, livestreaming as much as I could with the short battery life of my Samsung Galaxy S2, assisted by the powerbanks and portable solar panels lent to me by fellow protestors and supporters of Wikileaks that stopped by. I never learned the identity of the person who first mentioned Bitcoin to me in front of the Ecuadorian embassy in my sleep-deprived state – if they ever told me their name I forgot it almost immediately – but I remember learning that it had become the only way to economically support wikileaks after its financial deplatforming at the hands of Western governments, and I know that I came back home (after a scrapped attempt by the police to enter the embassy through its air vents in the middle of the night, which some credited livestreamers like me for stopping) with the idea of uncensorable money occupying much of my mind. I bought my first BTC on Mt. Gox a couple of months later.

BitcoinVN News: One of your more well-publicized activities over the past decade has been your contributions to “making Bitcoin a thing” in one of Europe’s longest-standing hereditary monarchies, Liechtenstein. How did this connection come about, and what are some of the ideas and inspirations from Liechtenstein’s unique governance model that you would like to see adopted elsewhere?

Andreas Kohl: Around the same time as I started working as a Tax Accountant, not long before discovering Bitcoin, I started an investigation on the role and importance of taxation in society. It started as a largely unbiased and apolitical investigation, motivated by a desire to justify my profession combined with a sinking feeling that something just wasn’t right with the world and my role in it. Nobody in my family or entourage had ever been very outspoken about politics, so I had no particular predisposition towards left or right-wing politics, and sought to create an objective and observation-based conclusion for myself, outside of and not influenced by partisan rhetoric.

It started with me making a an excel spreadsheet with a list of countries which I ranked based on levels of taxation on one hand, and perceived quality of life on the other, mainly using indicators such HDI and GDP per capita, which while flawed, were sufficiently accurate to paint a picture that, I must admit, somewhat surprised and dismayed me: Low tax countries tended to do fairly well for themselves, whereas there seemed to be no such correlation between very high levels of taxation and high development.

At some point, I discovered that the country which (according to my ranking) by far best exemplified the efficiency of a leaner government happened to have a Head of State who had (then recently) written a book on governance. Excited by the idea of having the closest thing to a “primary source” that could explain the results of my investigation, I rushed to buy a copy of The State in the Third Millennium by the Reigning Prince of Liechtenstein, Hans-Adam II.

This book put into words the conclusion that I was already intuiting from my observations of the world, and firmly entrenched the convictions that I still live by today, and which can perhaps be best summarized by one of the opening paragraphs in the book:

What kind of state does humanity want in the third millennium? President Kennedy, whom I had the honor to meet personally when I was a young man, said in his Inaugural Address in 1961: “Ask not what your country can do for you—ask what you can do for your country.” As a young, idealistic person, I was in those days convinced by this statement. Today, I may not have lost all of my ideals, but decades of experience in national and international politics, including many years as the head of state of a small but modern democracy, have convinced me of the truth of the reverse statement: Ask not what a citizen can do for the state, but rather what the state can do better for the citizen than any other organization. This organization could be a community, an international organization, or a private company. I would like to set out in this book the reasons why the traditional state as a monopoly enterprise not only is an inefficient enterprise with a poor price–performance ratio, but even more importantly, becomes more of a danger for humanity the longer it lasts.

Amidst his arguments against the “traditional state as a monopoly enterprise”, Prince Hans-Adam II also provides an alternative model: A competitive government which recognises the right of self-determination at the local level, and which must therefore treat its citizens like an enterprise treats its customers, for these citizens always have the option to opt-out of the services provided by the government, without necessarily having to emigrate.

What emboldened my fascination with Liechtenstein more than anything else was that Prince Hans-Adam II put these principles into practice, by amending the principality’s constitution in 2003 to give every municipality the right to secede from Liechtenstein; a historically unprecedented move, which far from causing disunity in the country, has only brought it closer together.

Indeed, if there is one thing that I believe the entire world should (and will eventually) learn from Liechtenstein, it’s that constitutionally guaranteeing the right to secede is the only way to ensure that the interests of all citizens of a country remain aligned, and the best method to pacify and even ultimately weaken separatist movements and sentiments. Instead of resulting in automatic balkanization as some might imagine, the right of self-determination at the local level changes the entire game theory of national politics and the incentives of national politicians in such a way that in order to succeed in this system, stakeholders of national governments must seek compromise and collaboration with local communities, as the backing of a simple majority across the nation is no longer sufficient to justify a particular policy or political campaign.

Over time, I came to see Bitcoin and the Liechtenstein model as inextricably linked; for while it took a benevolent and wise ruler reminiscent of the old ideal of “Philosopher Kings” to implement this model in Liechtenstein, it is also the path that all other governments will have to follow sooner or later, once it is no longer possible or practical for them to fund themselves through seigniorage or confiscation. The power of Bitcoin is precisely in that it makes a society based on voluntary association and private enterprise inevitable; it makes Liechtensteinization inevitable for all mankind, for every nation, no matter the size, culture, religion, history, or political structure.

A couple of years after my initial reading of The State in the Third Millennium, I made the case for Bitcoin as a better money and form of “digital gold” in my entry for the 7th Vernon Smith Prize, an essay competition organized by the Princely Family of Liechtenstein, and was awarded the third prize in this competition. The award ceremony was celebrated in February 2015, and as part of my acceptance speech I gave out paper wallets containing 5 Swiss Francs each worth (at the time) of Bitcoin to every person in the audience, including several members of the Princely Family, and Hans-Adam II himself, who as an advocate of the gold standard was sympathetic to my argument for Bitcoin. During this trip to Liechtenstein, I also convinced three merchants in the principality to start accepting BTC (two of which still do to this day). Since then, the Princely Family’s private bank, LGT – along with several other banks in the Principality – has also started offering BTC as an investment product to their clients.

BitcoinVN News: Your interest in Bitcoin and better governance models for the challenges of the 21st century seems to have naturally led you to El Salvador, where you now spend a significant part of your time. When did you first arrive in El Salvador, and what have been the most significant changes you’ve noticed since then?

Andreas Kohl: I bought my plane tickets to El Salvador almost as soon as the Bitcoin legal tender law was announced, and arrived in January 2022. This was a few months before the “State of Exception” which expanded the gang crackdown that President Bukele started a couple of years earlier. Contrary to popular belief (due to misinformation spread by mainstream media), the state of exception did not suspend due process or civil liberties; it simply ended the previous status quo where public prosecutors were overwhelmed (or corrupt) and unable to gather enough evidence to press charges on most captured gang members, resulting in what’s commonly known as a “catch and release” program, and it achieved this simply by increasing the number of days that a suspect could be held in detention before being formally charged in court from three days to 15. This has, in fact, – and contrary to statements made by many “human rights” organizations and mainstream media – allowed proper due process to finally take place for the first time, rather than prevent it.

Thus, when I first arrived, there were still many gang members out on the street, easily identifiable by their (very much deliberately) terrifying face tattoos. Although I luckily never had any direct encounter with any (and to my understanding they mostly left foreigners alone anyway), it was definitely a factor when it came to choosing a place to live, as real estate agents had to inform me of gang-imposed curfews near some areas where I was considering to live, and I have to admit that this did instill some unease in me. The state of exception started only two months after I arrived in El Salvador, and with it, I saw all remaining gang members disappeared almost instantly.

This wasn’t the first time that Salvadorans saw a pause in gang activity; previous governments had at times negotiated truces and temporary cessations of gang extortion, especially around elections. It therefore took a while for Salvadorans to put their guard down, and many of the popular precautions of yesteryear can still observed around the country today; residential communities surrounded by barbed-wire and protected by shotgun-wielding security guards, indoor car parking in almost every house, and barred windows, most notably. But new constructions rarely include many of these features, and a great number of existing residential communities are now starting to remove them one by one. My now-fiancée tells me that in her rural hometown of Sensutepeque, she used to hear gunshots on a virtually weekly basis, and that this has stopped altogether with the Bukele presidency (even before the state of exception). It’s understandably difficult to move on from the trauma that this kind of life inevitably brings, but from my observations this new reality is visibly starting to set in with the people of El Salvador – most now recognise that the safety is here to stay and that they are now free from the terror and intimidation that used to be omnipresent in their country.

BitcoinVN News: At this point, what areas in El Salvador do you see as most urgently needing more investment of time, manpower, and capital to further improve the country?

Andreas Kohl: Although I am not an expert on Salvadoran economy or public policy, I believe that a stronger rule of law – beyond merely cracking down on violent crime – is the first step to attracting significant levels of foreign investment in El Salvador. My current concern is that while the Bukele administration has had bigger problems to solve first, and has done so admirably (even miraculously) well, there has perhaps not yet been sufficient legal reforms to benefit the economy, and more attention probably needs to be paid to the disastrous regulations on industry and fiscal policies that they have inherited from previous administrations.

The extent of the damage done by the political duopoly that ruled since the end of the Salvadoran civil war in 1992 up until the initial nomination of President Bukele in 2019 reaches deep into all aspects of Salvadoran law, as far as the constitution itself. This constitution was clearly designed to divide the country between two adversarial parties which did not trust each other and sought to keep power to themselves and their entrenched interests, at odds with those of the Salvadoran people. One clear example of this is the one-term limit which President Bukele skirted around by using a loophole that was originally designed to keep either party from impeaching the other and therefore getting the presidency “before their turn”.

It is my humble opinion that President Bukele should seek to change the constitution to reflect the new reality of El Salvador, rather than have to employ such loopholes.

Moreover, while I applaud the voluntary nature of the Bitcoin initiatives in El Salvador, and understand why the Bitcoin law has not been enforced to the extent of imposing fines or other penalties on small businesses and merchants who do not yet accept Bitcoin, I have a hard time accepting that the Bitcoin legal tender law exists on paper with no clear mechanism of enforcement or gradual implementation plan. I believe that it is better to have no law at all than a toothless one.

These are relatively small matters (which in the grand scheme of things have little importance), but I believe that they exemplify a larger and more systematic problem in El Salvador; now that it is crime-free, the country is ripe with potential for development and could truly leapfrog the rest of the continent to become the greatest success story of the Americas as well as its most important economic powerhouse – but first, investors must be presented with legal clarity and an assurance that a strong and independent judiciary will enforce the law in its entirety, efficiently and equally for all.

BitcoinVN News: Who might find El Salvador to be an attractive option right now, and for whom might it not be the most suitable environment, based on personality or preferences?

Andreas Kohl: Until there are further fiscal and regulatory reforms (or the creation of an autonomous Bitcoin City), I would mainly recommend El Salvador to retired Bitcoin whales with no fixed income, or digital nomads who have a different tax residence (or none at all in the case of perpetual travellers), and especially to Bitcoiners who wish to experience life on the Bitcoin standard – it is the only place in the world that I know of where one can truly live on Bitcoin without too much complication. As for climate, although most of the country is tropical, one can also find some fresher places to live at higher elevations, so I wouldn’t necessarily worry about this. If you love good coffee and chocolate, latin culture, beautiful beaches, volcanoes, surfing or mountain hiking, urban city life or a more rural life in touch with nature, you will find what you’re looking for in El Salvador.

BitcoinVN News: In your professional life, you’ve dedicated the past two years to Concatena Labs and building Sequentia, a “Bitcoin-anchored sidechain for disintermediated, tokenized finance.”

What specific problems does Sequentia address that other Layer 2 solutions currently fail to solve? And who do you anticipate will be the early adopters of Sequentia?

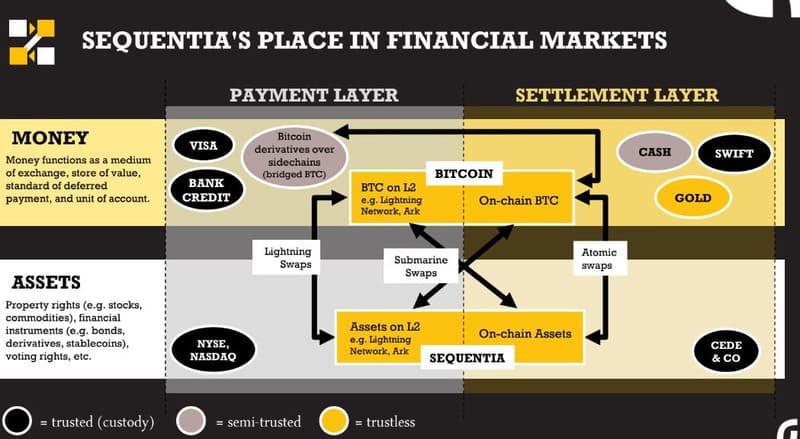

Andreas Kohl: First, I would like to note that I do not consider Sequentia to be a Layer 2. There are two definitions of L2 as far as I’m concerned:

First (and most vaguely), a L2 must be a solution for scaling Bitcoin payments – this definition is not very useful in my opinion, since it makes any network with a bridged Bitcoin derivative (such as Ethereum with WBTC) a L2.

The second, more strict, and in my opinion more useful definition is any off-chain network for payments which offers unilateral and non-interactive exit back to L1. By this definition, only the Lightning Network and Ark are Bitcoin L2s.

Sequentia is not a Bitcoin L2 by either definition. Sequentia is a blockchain (therefore a L1); but it is not a standalone blockchain, in that it is tied to the Bitcoin network and would cease to function or exist if the Bitcoin blockchain also ceased to function or exist. In this sense, it is a sidechain of Bitcoin, and could perhaps be considered a “L1.5”.

This connection between Sequentia and Bitcoin will be in the form of “Anchoring”; what we refer to by “anchoring” and by describing Sequentia as an “anchored sidechain”, is a consensus rule which requires every Sequentia block to contain a reference to a Bitcoin block at an equal or greater height than the Bitcoin block referred to by the previous Sequentia block.

The purpose of Anchoring is to enable better and faster peer-to-peer (Atomic/Lightning/Submarine) swaps between assets issued on Sequentia and “real” Bitcoin (on the mainchain or on a L2 like Ark or the Lightning Network).

To illustrate this, one should consider that cross-chain atomic swaps have been around since 2014, when the first trustless swap was performed between Bitcoin and Litecoin. In a nutshell, it is possible for one to send BTC on the Bitcoin network, and attach a “secret” that locks these BTC and which the recipient can only unlock by sending an agreed amount of LTC (on the litecoin network) within a specific time period, after which the BTC would be returned to the sender if not unlocked by the recipient. However, such a swap between independent and unsynchronised networks like Bitcoin and Litecoin requires additional timelocks for reorg protection. That is because if we were to consider the swap finalized after only one Bitcoin confirmation, and said Bitcoin block was orphaned (causing a reorganization of the Bitcoin network), the original owner of the BTC would have their BTC back while still holding on to their counterparty’s LTC on the Litecoin network. In contrast, the Sequentia network is fully synchronized with the Bitcoin network, such that both chains always reorganize together and swap transactions on Sequentia can be considered immediately finalized relative to their Bitcoin counterparts; if the swap transaction disappears in Bitcoin, it must also disappear on Sequentia.

Furthermore, Sequentia is the first blockchain with no native coin for transaction fees, and which instead allows users to propose transaction fees using any asset issued on the network. This means that not only do users not need to “peg”, “wrap”, or “bridge” their BTC to the sidechain, unlike all other existing sidechains, but they also do not need to own any specific other cryptocurrency to pay for transaction fees; instead, they may attempt to pay transaction fees using any asset which is issued in and which they wish to transfer on Sequentia.

We believe that Bitcoin will ultimately become the single global monetary standard, and that L2s will be used to scale Bitcoin payments; Sequentia does not therefore attempt to offer an alternative money, but is instead dedicated specifically to all other types of assets and property rights, most of which must (unlike money) intrinsically have a central issuer and therefore very different trust assumptions than Bitcoin. However, despite the trust that is inexorably placed on issuers of such securities by those who purchase them, we affirm that there is great utility in being able to make such purchases without necessarily having to place additional trust towards trade intermediaries, as is the case in traditional or “legacy” financial markets, and especially in being able to do so with near-instant settlement (preventing pernicious and unfortunately all too common market manipulations such as naked short selling) and using self-custodied BTC.

Sequentia will also make use of Bitcoin L2s (which could be considered as “L2.5s” when used to scale transfers of assets issued on Sequentia); the ultimate “product” that Sequentia will be used to access will therefore be “Lightning DEXs”, that is, decentralized exchanges where users will be able to trade BTC on L2s for assets issued on Sequentia (whether or not they are in L2 channels of their own). In this way, Sequentia is perhaps most comparable to Bitcoin metaprotocols such as RGB and Taproot Assets, which envision a similar user experience / journey.

However, metaprotocols deployed over the Bitcoin network must intrinsically occupy space in Bitcoin blocks by committing data to Bitcoin UTXOs. Contrary to popular belief, there is no way to “issue an asset in Lightning” using metaprotocols; instead, one must first issue an asset inside a Bitcoin UTXO and then create asset channels using another Bitcoin UTXO before such an asset can be transferred over the Lightning Network. Even if one assumes that most transfers of most metaprotocol assets will occur over Lightning, one must still accept that data will be committed to Bitcoin UTXOs whenever:

- An asset is first issued, or re-issued in the case of a supply expansion.

- An asset channel is opened, closed or rebalanced.

- An asset with insufficient liquidity or adoption is transferred (on-chain, since such an asset can’t viably be used over Lightning).

We believe that demand for Bitcoin blockspace will only keep growing and that such data commits will therefore only keep getting more expensive, such that the Bitcoin blockchain will ultimately only be used for monetary settlements, and that disintermediated global financial markets can therefore not be sustained on Bitcoin using metaprotocols.

This is why we believe that sidechains like Sequentia are necessary. However, as previously mentioned, all existing sidechains to date (e.g. Liquid and RSK) rely on pegging or bridging Bitcoin, thereby fragmenting network effects and competing with real L2s (while being much worse for the purpose of scaling Bitcoin payments than a real L2) instead of integrating them as we propose to do with Sequentia.

BitcoinVN News: What is the current status of the project, and what’s on your roadmap for 2025?

Andreas Kohl: We have a live testnet and a prototype wallet connected to said testnet (which you can find here – currently on Android only) which showcases the ability to propose transaction fees using any asset issued on the network. We will soon (after securing funding) begin working on Anchoring, and should be ready to launch the Sequentia mainnet sometime in 2025.

BitcoinVN News: What are some of the best resources to learn more about Sequentia, and where can people follow you and your team?

Andreas Kohl: You can find our documentation (whitepaper and testnet node instructions) here, keep up with the latest news on our X profile here, or connect with our team and community on Telegram or Discord.