We’ve heard the stories of people getting scammed, losing money and worse. This explains why governments and financial institutions around the world are hesitant to allow crypto currency use within their countries. And although most crypto currencies don’t benefit most people, a specific type of crypto currency – Stable Coins – are used everyday by millions of people as a way to send payments. Stable Coins are a different type of crypto currency that can best be described as digital dollars.

In a world where the banking system restricts when, where, and how you choose to use your money- Stable Coins function like how digital money should work in the modern day.

Knowing what they are and how they work can benefit those of use who live and work abroad, where dealing with banks is complicated or outright impossible.

A Stable Coin Is A Crypto Currency That Is Tied In Price To Some Other Currency

Stable Coins can be linked to things such as dollars, euros, and even commodities such as gold or oil. They are called ‘stable’ because their price is supposed to not change and reflect the value of what it’s linked to.

A $1 dollar Stable Coin is supposed to equal $1 US dollar and a €1 euro Stable Coin is supposed to equal €1 euro. This means that you can have the value of $1 dollar in digital form and use it online for buying goods and services or sending it globally.

How do Stable Coins hold their value?

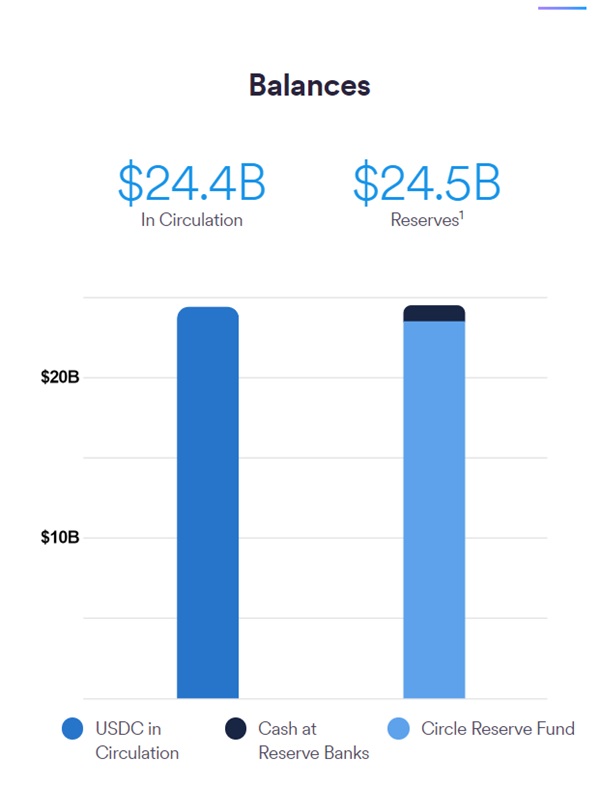

Just as banks are supposed to hold sufficient government Treasuries for the amount of deposits they hold for your bank deposits, stable coin organizations also hold the government Treasuries and other cash-equivalent assets necessary to back their issuance of Stable Coins.

This is how Stable Coins keep their value and why they are used by millions of people around the world.

The most trusted and widely used Stable Coins are USDT (Tether) and USDC (USD Coin by Circle) who regularly published their audited reserves on their respective websites (Tether reserves – Circle reserves).

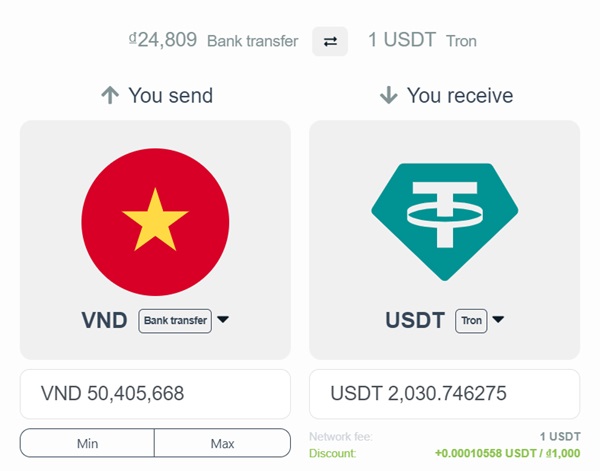

Both, USDT and USDC, can be purchased directly via bank wire in Vietnam from BitcoinVN.

Not All Money Online Can Be Used Equally

If I want to buy something online, I simply can’t pay with my online bank checking account- I would need to use a credit or debit card. Or if I want to send money to a friend for splitting a meal bill, I would need to send money to them through a mobile app. Just because we have money in a bank account doesn’t mean we have permissions and access to use it.

This is what makes stable coins useful and different from our normal banking methods, it can be sent instantly and without anyone’s permission from various wallets and apps. The implication of this means that anyone, regardless of race or nationality, now has access to dollars or euros as a Stable Coin. Argentinians can now save in dollar-Stable Coins instead of their devaluating Argentinian Peso, and Filipino-Americans can send money directly to family in the Philippines conveniently from home. Stable Coins allow for truly digital money movement online whereas banks are limited to amount, fees, time and availability. This alternative of money breaks the constricted traditional bank rules and opens up a new way for people to save and access their money.

Stable Coins allow for digital payments and transactions to be made in ways that normal currencies can’t and it gives money access to more people around the world. For those lucky to be from the US or Europe, access to dollars or euros has never been a problem, but for most people around the world with irresponsible governments and weak currencies, access to dollars is highly sought after, difficult to get and more expensive to convert. Stable Coins have allowed access to different monies around the world.

This opens up possibilities and uses for those of us who live and work abroad.

A Challenge Expats Face Is How To Send Money Back Home- Whether For Savings, Paying Off Bills, Or Supporting Family And Friends.

Normally, to send back home we must make a trip to the bank with the proper documentation, wait in line, fill out forms and pay bank transfer fees. With the knowledge of what Stable Coins are and what they can do, we now have an alternative way of sending money.

From practically anywhere, we are able to convert our VND into USD Stable Coins and transfer the money online. The trade-off is that we need 2 online crypto exchanges, one in Vietnam and another in your home country such as Coinbase or Kraken. Nearly every country has a crypto exchange and through the exchange is where we link our bank account. The 2 exchanges linked to each respective bank account allows you to move money home. Thus allowing you to transfer any amount you want, when you want, quickly with almost zero fees.

By using 2 crypto exchanges in each country linked to our respective bank accounts, we are able to send money from Vietnam back home. Stable Coins are how we transfer that value. To use a train analogy: 2 train stations represent our crypto-bank accounts in each country, and Stable Coin is the train that moves to and from.

The ability to move money globally with stable coins can be of useful for those of us who live and work abroad with responsibilities back home. To learn step-by-step on how to send Stable Coins, check out my previous article here.