Phew… where to even start?

Behind us lies the certainly most eventful week of the past decade with unbelievable revelations coming out on an almost hourly basis.

If you’re looking for a succinct summary of the events of the past week, El Risitas has you covered.

At the same time markets again took a nosedive as the fear of more forced sellers entering the market shook confidence.

Good time for steady stackers, not such a good time for people who were operating on margin.

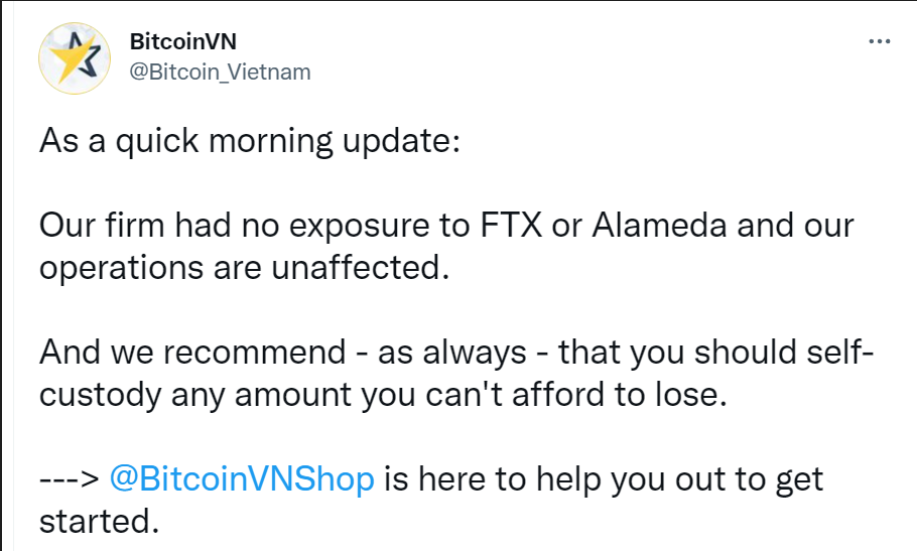

Impact on BitcoinVN

As we mentioned previously via our official Twitter account, BitcoinVN did not have any exposure to FTX or Alameda.

Now the question of course is: Can you trust us that this statement is truthful?

The answer is pretty simple:

You should not need to trust anybody with your money!

And while you *can* store your assets with BitcoinVN – we have always been encouraging our clients to learn about self-custody and taking possession of their coins.

Any credible platform perceives providing custodial services *as a liability* or charges at least a clear service fee for providing such service.

Any platform which solicits to deposit your coins with them should be treated with maximum suspicion.

On Chain Bitcoin vs Paper Bitcoin

One of the first things you “learn” about Bitcoin is that its value proposition partially stems from its hard-coded, fixed supply of 21 million Bitcoin.

Now – what if we told you that the amount of paper Bitcoin (claims (“IOU”)) has likely been rising above 100,000,000 Bitcoin in the last cycle?

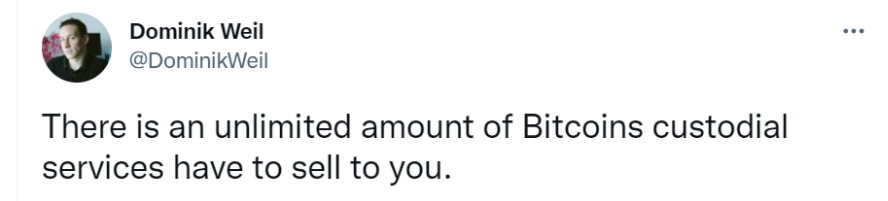

There is a huge difference between having a “Bitcoin balance” with a custodial service provider versus actually possessing Bitcoin.

Bitcoins whole value proposition goes out of the window if you do not take possession of it.

There is no limit to how many unbacked “Paper Bitcoin” a service provider might sell you – as long as you do not withdraw your coins.

Only once you attempt to withdraw you find out if you actually bought Bitcoin – or just financed the vices of some of the more shady operators in the space.

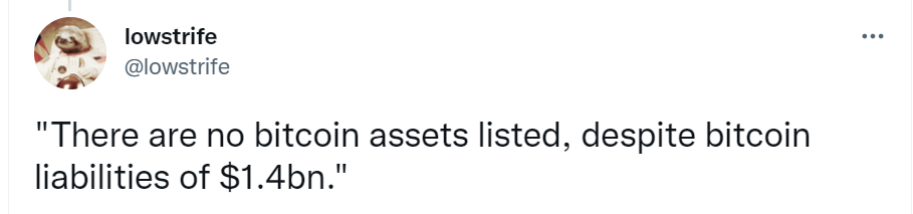

As it turned out in the case of FTX – they did not have any real Bitcoin to back the paper Bitcoin claims their customers had against them.

Their customers *thought* they were buying Bitcoin.

But their funds all got funneled into the coffers of some of the more unsavory characters of our time.

The overall fallout of the FTX collapse has caused widespread damage across the ecosystem.

We know that there are more insolvent entities still operational who are currently soliciting investments and deposits to cover up holes in their balance sheet.

In the current macro environment this seems rather unlikely to us to succeed.

Expect more withdrawal halts from lending platforms, exchanges and other custodial service providers in the days and weeks ahead.

Do not be complacent about it if you have any serious funds with any of these platforms.

Educate yourself about self-custody and withdraw your funds before it is too late.

Where we go from here

It’s really pretty simple:

If the paper Bitcoin promoters can keep fooling the majority of the people to hand over their money for fake Bitcoin custodied by centralized service providers, the current world order will continue in its path unabated.

If however a sufficient number of people demands to have their Bitcoin on-chain – and keeping their own keys for their own coins… things will change.

Satoshi built Bitcoin to free humanity from the shackles that come with centralized control over the money supply of a nation in the hands of the selected few.

We are at an extremely crucial point for what’s ahead for humanity at large.

And while there’s “money to be made” in promoting paper Bitcoin – we will all pay a hefty price for it in the future if we let these harmful narratives go unchallenged.

As for BitcoinVN:

We will continue to play our part in building out the basic infrastructure.

We are operating Vietnam’s oldest on/offramp from/to VND , we are aiming to keep our KYC/AML requirements at the minimum level necessary (to protect ourselves and our users).

We are also operating a fleet of Bitcoin ATM across Vietnam which let you in a privacy preserving manner convert your cash into Bitcoin (and vice versa).

We will keep investing into payments and self-custody solutions and infrastructure to increase access to the tools necessary to become self-sovereign.

We will keep supporting Open Source developers and projects who are doing Satoshi’s work in building out valuable tools & infrastructure.

And we will always advocate for people to self-custody over trusting third parties with their savings.

Our future depends on it.

The battle has just begun.