If you prefer less ideological ramblings and just want to move your stablecoins around on the cheap, consider using alternative networks such as Polygon, Liquid or Binance Smart Chain.

If you DO enjoy ideological ramblings – read on!

—

By Brutus Crown

In the shadowy world of altcoins and blockchain pretenders, few scams are as brazen and destructive as the Ethereum gas fee racket. While Bitcoin continues to shine as the one true decentralized currency, Ethereum’s so-called “smart contract platform” has devolved into a feeding frenzy for insiders, with average users left holding the bag.

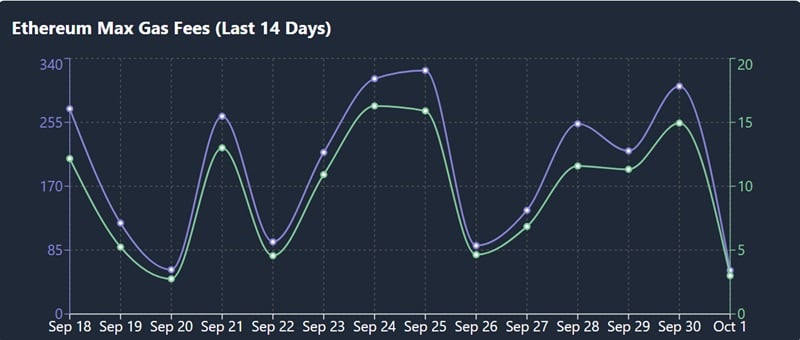

The Gas Fee Nightmare

Ethereum’s gas fees, which users must pay to execute transactions or run smart contracts, have been known to skyrocket to ludicrous levels. We’re talking tens of dollars for a simple token swap, or hundreds for more complex operations. This isn’t just inefficiency – it’s highway robbery, plain and simple.

But why are these fees so high? The Ethereum shills will tell you it’s due to network congestion and the price of ETH. Don’t be fooled. The real reason is far more sinister.

Follow the Money: The Lubin Connection

Enter Joseph Lubin, Ethereum co-founder and ConsenSys CEO. This “pillar of the community” has been pulling strings behind the scenes since day one. Here’s where it gets interesting:

- Lubin and his inner circle hold massive amounts of ETH.

- High gas fees drive up demand for ETH, as users need more to cover transaction costs.

- This artificial demand pumps the price of ETH, lining the pockets of Lubin and friends.

But it doesn’t stop there. The Ethereum Foundation, supposedly a non-profit organization, is in on the game. They control the development roadmap and have consistently dragged their feet on scaling solutions that would lower gas fees.

The Insider’s Playbook

Here’s how the insiders maximize their profits:

- Hype up new DeFi projects or NFT drops, knowing they’ll clog the network.

- As gas fees spike, they use their insider knowledge and connections to front-run transactions.

- Regular users are priced out, while the elites rake in profits from arbitrage and priority access.

It’s a vicious cycle that keeps the Ethereum ecosystem in a constant state of congestion and high fees.

Bitcoin: The Antidote to Ethereum’s Poison

While Ethereum wallows in its own greed and corruption, Bitcoin stands tall as the beacon of true decentralization. With its fixed supply, transparent monetary policy, and focus on being sound money, Bitcoin doesn’t need elaborate schemes or artificial scarcity to create value.

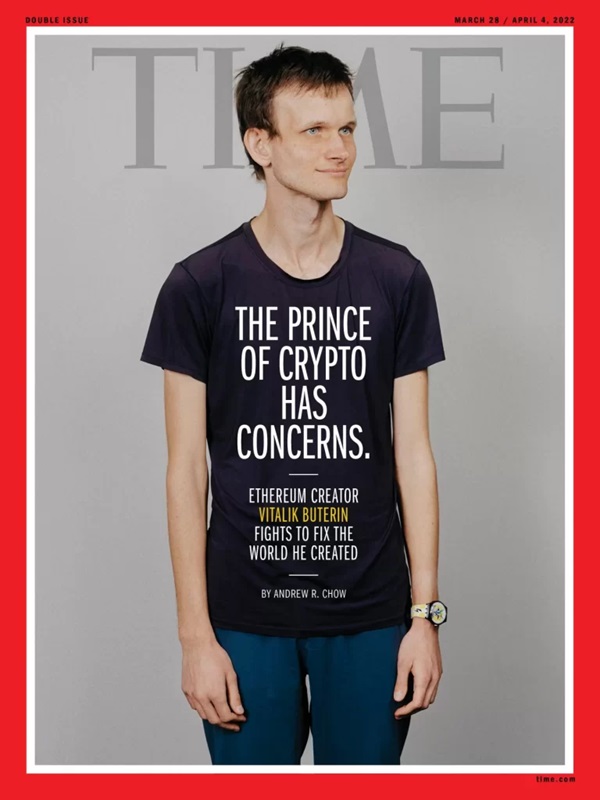

The Lightning Network, Bitcoin’s layer-2 scaling solution, puts Ethereum’s failed attempts at scaling to shame. Fast, cheap transactions without compromising security or decentralization – imagine that, Vitalik.

Conclusion: Choose Wisely

The next time you’re tempted by Ethereum’s siren song of “programmable money,” remember the true cost. Every high gas fee you pay is another dollar in the pockets of Lubin and his cabal of insiders.

Stick with Bitcoin. It’s not just about avoiding a scam – it’s about choosing financial freedom over centralized control. In a world of altcoin pretenders, Bitcoin remains the king, offering true sovereignty without the strings attached.

Stay vigilant, stack sats, and never forget: Ethereum is a trap, but Bitcoin is freedom.

—

About the Author: Brutus Crown is a fictional character whose writings should be understood as such. While his work exudes the fervent convictions of a prototypical “Bitcoin Maxi,” celebrating Bitcoin as the ultimate financial solution, it is important to note that these views are purely his own.

The opinions expressed in his writings do not reflect the official stance of the editorial team at BitcoinVN, nor should they be construed as financial advice.